As we entered the year 2024, the real estate market has been approaching tectonic changes that will redefine how business is conducted today. Be it seasoned investors, first-time homebuyers, or real estate professionals, the trends are imperative to understand in order to formulate valid decisions in an increasingly complex market. It’s an all-in-one guide to the top 20 real estate market predictions that will not only take you through the storm but also help you be ahead of the game.

The last couple of years have been really unpredictable for property markets, thanks to various influences such as the global pandemic, changing interest rates, and shifting consumer preference. While these dynamics are almost sure to continue shaping the real estate market looking ahead, just like any new trends or developments would have immense implications for property values and investment prospects, buyers’ behavior in the markets.

Current Real Estate Market Overview (2024)

Key Statistics from 2024

An oscillating trajectory of home prices, rising interest rates, and an ever-present supply-demand mismatch in housing define this year.

- Housing Prices: Zillow claims that the average house price went past $348,000 in the United States in 2023/2024, which is 5% higher than the previous years. Although this is a moderation from the high growth of the past two years, it still depicts considerable demand in the housing market.

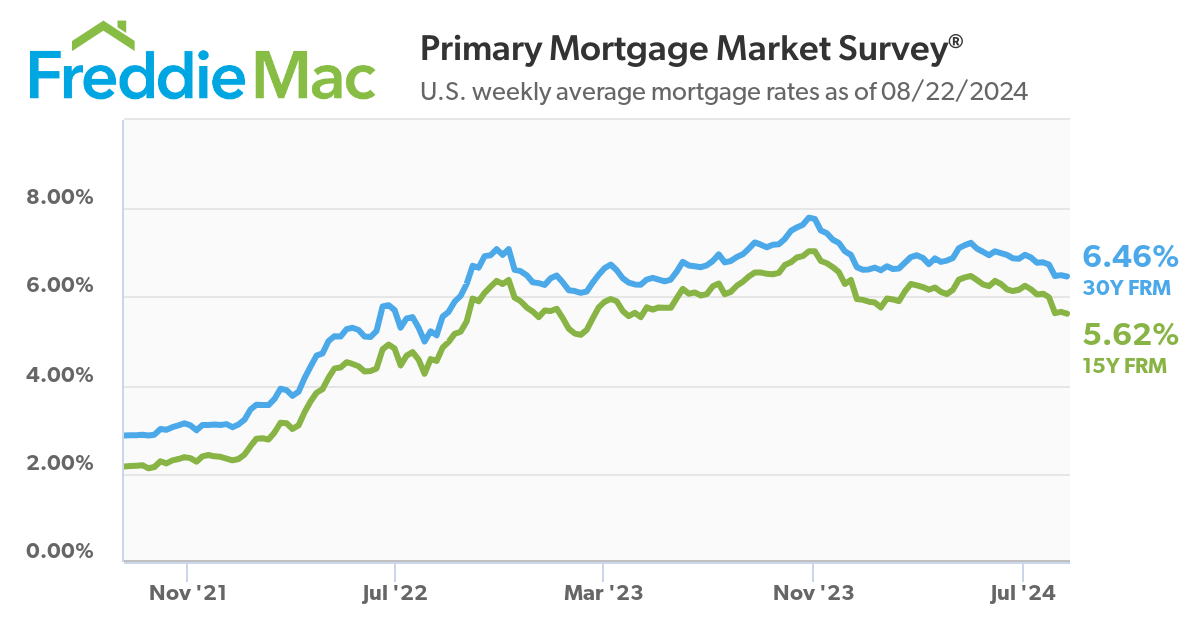

- Mortgage Rates: At the end of 2023, the average 30-year fixed mortgage rate peaked at 6.5%, while it was merely 3.5% at the start of 2022. No doubt, such a drastic change made for a cooling housing market due to skyrocketing costs of borrowing, reducing affordability to many buyers.

Source: freddiemac

Source: freddiemac

- Inventory Levels: The supply of homes for sale stayed tight throughout 2023, as inventory levels wavered around 1.2 million units nationwide. Compared to that, this brings in a supply of only 2.5 months; even against the benchmark of a 6-month supply, the balance between buyers and sellers is out of whack.

Here’s a table summarizing the key statistics:

| Metric | 2023/2024 Value |

|---|---|

| Median Home Price | $348,000 |

| Average 30-Year Mortgage Rate | 6.5% |

| Housing Inventory | 1.2 million units |

| Months of Supply | 2.5 months |

Major Events and Their Impact on Real Estate

Several major events in the year 2023 bent and shaped the outlook of real estate, and most probably will continue doing so through 2024 and 2025. Among such events is the after-effect of the COVID-19 pandemic, still underway and geared toward driving changes in buyer behavior and housing demand.

Most people have been at home for so long that they are now eyeing permanent remote work arrangements. Interest in suburban and rural areas is spiking consequently due to people seeking more space and a better quality of life apart from dense city centers.

Another of the big factors at play has been inflation. Consumer price index growth reached 7.1 percent in 2023—the highest in more than forty years. It also means higher prices for building materials, labor, and other inputs; it raises the cost of new construction and adds to home price pressures.

Another layer of uncertainty heaping upon the global economy is geopolitical tensions, especially the Russia-Ukraine war. Causing an energy crisis, it has had ripple effects on many other businesses, including real estate, by increasing operational costs for property owners and developers.

Lessons Learned from 2023

The real estate market of 2023 returns with some lessons to be carried into 2024 and 2025:

- Adaptability Is Key: That has been one of the critical factors for success in the real estate industry: the ability to adapt to changing circumstances, be it shifting buyer preferences or rising costs.

- Long-Term Planning: Despite the short-term volatility of the market, those who took a long-term view generally did better. Real estate remains an excellent asset class for those willing to hold through the cycles of the market.

- Technology as a Game Changer: The adoption rate of technology—whether virtual tours or blockchain-based transactions—has, in fact, become imperative if one is to remain competitive in the market.

All these lessons will continue to echo as we take up the real estate market prediction in 2024/2025.

Real Estate Market Predictions 2024 Trends

Prediction 1: Further Interest Rate Fluctuation

A big real estate market driver in 2024 will be the change in interest rates. The Federal Reserve has said interest rates will change based on the current trend of inflationary pressures and economic conditions. That might produce periodic increases or decreases in mortgage rates, hitting squarely on home affordability and buyer demand.

Impact on Homebuyers: Higher interest rates make the monthly mortgage payment expensive, which should definitely push out first-time homebuyers or even those living on the edge of affordability. On the other hand, if the rates decline, we will see demand surge as house buyers rush to lock in the lower rates and hence drive up house prices further.

Case Study: Interest rate hikes in 2022 and 2023 have significantly slowed home purchases across demographics, but especially amongst young homebuyers. Much of this was due to the fact that most of them just preferred to wait for better rates, hence fueling demand on the rental side. If the trend were to sustain itself, we might see a similar case of delayed purchases among prospects in 2024 and 2025, hence affecting market dynamics at large.

Prediction 2: Housing Supply Will Remain Constrained

It’s unlikely that supplies of homes will be adequate in 2024, much like in the past few years. Several factors contribute to this: labor shortages, supply chain disruptions, and zoning regulations against new construction.

Prices: Given the limited supply and stable demand, house prices should be resiliently high but might fade a little in terms of growth rate from the explosive gains witnessed in 2020 and 2021. That sets up a good environment for sellers, especially in the most sought-after areas, and a more competitive space for buyers.

Statistical Insight: A National Association of Realtors report indicates that there is currently a deficit of about 5.5 million housing units in the U.S. That shortage has already greatly contributed to surging prices and will continue unless dramatic steps are taken to spur building activity.

Forecast 3: Suburban and Rural Growth

The shift to suburban and rural living, accelerated by COVID-19, will prevail through 2024. As remote work became permanent, so did the demand for bigger homes with more space and access to outdoor amenities for a lot of employees.

Trend Analysis: This trend is going to further accelerate in 2024, with increasingly more buyers eyeing properties outside principal urban areas. Since this is the trend, property prices will rise in those places, accompanied by increasing investment in infrastructure and services catering to the rising population.

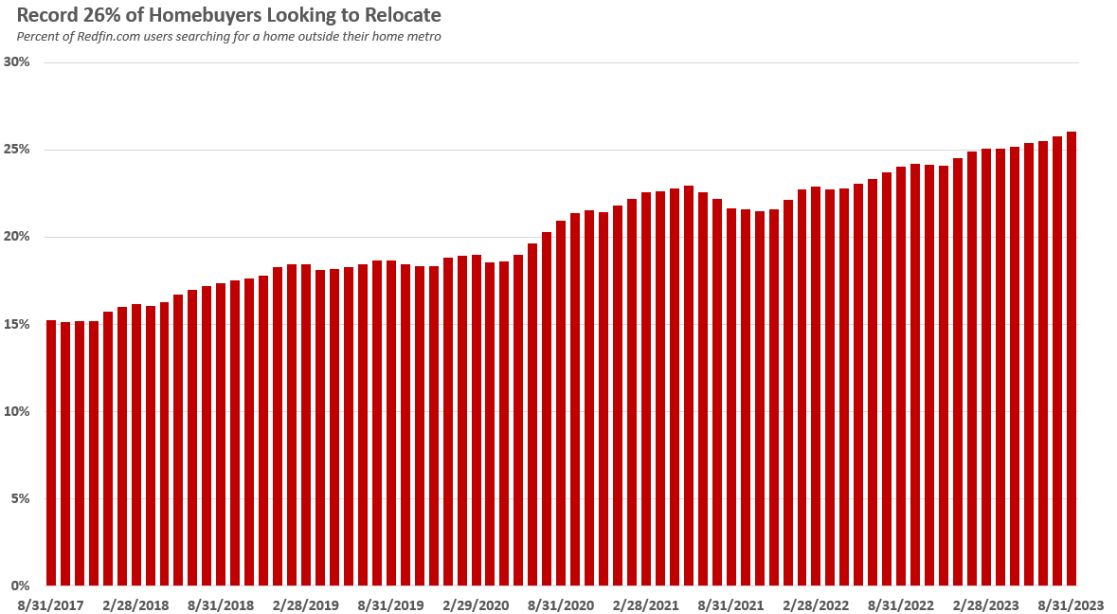

Data Point: In 2023, according to the survey, a study by Redfin found that nearly 30 percent of homebuyers were looking to move to a different metro area. Geographically, more of them preferred to relocate to smaller towns and cities. This trend is likely to further encourage the shifting trend in 2024, particularly with the permanency of remote work options most companies have adopted.

Source: Redfin

Source: Redfin

Prediction 4: Multi-family properties will attract more investment

With the pressure from affordable housing shortages, most especially in urban areas, rapidly increasing, 2024 will see more interest shifted toward multi-family properties. Builders and developers will focus on constructing or buying apartment complexes and other multi-unit dwellings to supply more affordable worker housing.

Rental Market Impact: This could pad the available inventory of rentals, which may have a stabilizing, or perhaps even reducing, effect on rental prices in some markets. Moreover, multi-family properties offer investors an opportunity for steady cash flow, more so in locations where demand for rentals is quite high.

Chart: Below is a chart illustrating the expected growth in multi-family property investments from 2023 to 2024, based on data from Real Capital Analytics:

| Year | Multi-Family Investment (in billions) |

|---|---|

| 2023 | $120 |

| 2024 | $135 (projected) |

Prediction 5: Integration of Technology in Real Estate Transactions

2024 has been a year when technology has further integrated with real estate transactions. From blockchain-based property records to AI-driven home valuations, technology is about to redefine the way real estate is purchased, sold, and governed.

New Technologies:

- Blockchain: Transparent property transactions without intermediaries and more secure.

- AI and Big Data: Next-generation valuations and predictive analytics for property.

- Virtual Reality (VR): Immersive virtual tours, remote property inspections.

Industry Insight: Technology in 2024 has helped real estate companies gain an edge in the competitive market, thereby improving services and efficiencies in transactions. For example, blockchain technology may significantly reduce the closing times of property deals by eliminating the necessity of third-party verification.

Real Estate Market Predictions for 2025

Prediction 6: Stabilization of Home Prices

Finally, by 2025, there will be a realistic stabilization of home prices after their super rise in the last few years. Many elements would lead to this equalization: increased housing supply, economic adjustments, and maybe higher interest rates. The market may come to an equilibrium point in which the appreciation associated with inflation and income growth is somewhat more balanced, presenting an easier environment for both sets of entities.

What this could mean for buyers and sellers: More stabilized prices are likely to bring down the bidding wars and make home buying easier to plan. Sellers, too, would find some respite. While the rapidity of price gains might fade, a more stable market could eventually translate into more reliable demand and shorter listing times.

Case Study: Over the last two years, home prices have surged over 40% in cities like Austin and Boise; in 2025, price movement is expected to be much more moderate as markets finally cool off, a reflection of returning to normalcy after years of high volatility.

Prediction 7: Sustainability and Green Building Practices

Residential homes that are sustainable and efficient are projected to have increased demand from consumers, who have varied preferences and changing regulations. Today’s home buyers place significant importance on eco-friendly features like solar panels, energy-efficient appliances, and building materials. In connection with this, these features can result in increased government building codes, where most of these codes place more emphasis on low carbon footprints and sustainability.

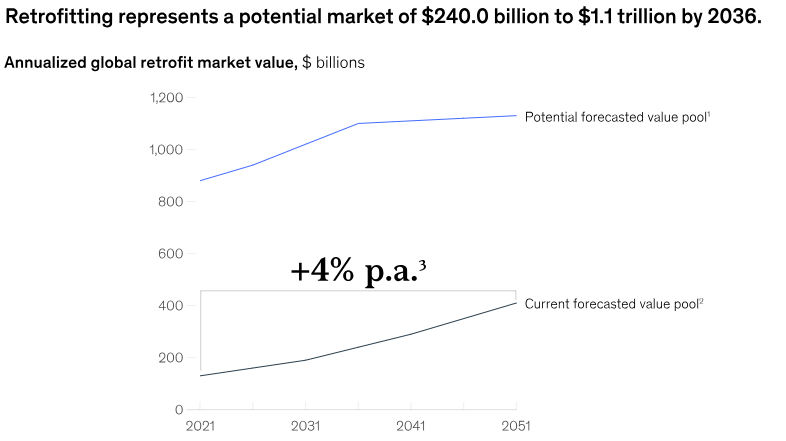

Trend Analysis: Builders and developers who focus on green practices are therefore likely to experience a higher demand for their products. Therefore, this trend also opens up opportunities for retrofitting old homes with sustainable features, creating a potential lift in the market for renovation services.

Data Insight: According to a report from McKinsey & Company, the green building materials market would increase by an 11.6% compound annual growth rate between 2020 and 2027. This increase is likely to be reflected in the real estate market because new developments, including almost a large proportion of them, will have sustainable practices by 2025.

Prediction 8: Co-living and shared housing models

The co-living trend saw its initial surge in major urban areas and is continuing with a surge well into 2025.

The co-living market has been very alluring to younger demographics in more expensive cities because of the shared amenities and communal living that come with co-living spaces. This makes co-living a viable alternative to traditional renting or homeownership when housing affordability continues to be an issue.

Impact on Urban Markets: Coliving can become an influential asset class in the rental market in densely populated city centers and make living more affordable because of the flexibility it offers in a lower cost. This model is also likely to attract investors due to the possibility of high occupancy levels and steady rental income.

Example: WeWork has already done that with its brand WeLive, offering fully furnished apartments that share amenities. By 2025, many more real estate developers will have moved into the market, especially in some of the world’s priciest places to live, such as New York, San Francisco, and London.

Prediction 9: Sustained Growth in PropTech Innovation

With property technology, or PropTech, ranging from startups to companies providing technology-driven solutions for the real estate industry, growth has surged and will continue well into 2025. Definitions range from AI-driven property management systems to blockchain real estate transactions to VR home tours.

Major PropTech Innovations to Look Out For:

- Smart Home Technology: Integration of IoT devices to manage security, energy efficiency, and convenience.

- AI and Machine Learning: Data analytics, next-gen, will empower market predictions, property valuation, and customer service.

- Blockchain: Transparency will be increased in property transactions and will also help to diminish fraud.

Market Forecast: The pace is such that, according to a Fortune Business Insight study, global investment in PropTech may cross $20 billion by the year 2025 alone. Companies and investors are only now realizing the potential technology has to offer in changing the face of real estate.

Prediction 10: Greater Emphasis on Affordability Initiatives

By the year 2025, there should be more emphasis on affordability initiatives by both the private and public sectors. Since the bulk of the housing problem lies in the area of affordability, conversely, more pressure and initiative will be applied to provide affordable housing solutions, most likely by building more affordable units and offering greater subsidies and incentives for first-time homebuyers.

Government Involvement: Governments at all levels will be able to create or enhance programs that will make it easier to purchase a home. This may take the form of a down payment assistance program, a tax credit, or a grant to enable low- to moderate-income families to buy homes.

Table: Overview of Expected Affordability Initiatives by 2025

| Initiative | Description | Potential Impact |

|---|---|---|

| First-Time Homebuyer Programs | Expanded eligibility and increased funding for down payment assistance | More families entering the housing market |

| Affordable Housing Development | Incentives for developers to build affordable units | Increased supply of affordable homes |

| Rent Control Measures | Implementation or expansion of rent control in high-cost areas | Stabilization of rental prices |

Conclusion

recap of the top 10 Predictions

In a nutshell, the trends that have huge potential to shape real estate in 2024 and 2025 will be formed by the confluence of economic variables, technological developments, changing buyer behavior, and new trends. This includes sustainability and remote work. Suburban markets, smart cities, and tech-driven transactions are expected to grow, while high interest rates and house price increases are likely to stall market optimism.

Final Thoughts

With changing times in the real estate scenario, one has to be better informed and more proactive. Understanding the trends and predictions as a buyer, seller, and investor will help you confidently move forward through the shifting real estate market.

Keeping an eye on economic indicators, consulting with experts, and making decisions that align best with your long-term goals will let you survive the 2024–2025 market changes.

Frequently Asked Questions (FAQs)

What are the major drivers for the real estate market in 2024 and 2025?

They range from economic conditions and interest rates through housing demand and supply, government policies, and technological advancements to working from home, urbanization, and sustainability trends, which are strongly prevailing in the market.

How Rising Interest Rates Will Impact the 2024–2025 Housing Market

This can be expected to cool the housing market as rising interest rates make mortgages more costly, affecting sales and reducing the growth in home prices. Thus, buyers may have to bear higher monthly costs, which will reduce affordability and perhaps decrease demand.

Which region is expected to experience maximum growth in the real estate market?

The biggest growth is likely to happen in suburbs and smaller cities, with more affordable homes, a better quality of life, and the opportunity to work remotely. Other growing real estate markets will include Sun Belt states like Texas, Florida, and Arizona, which benefit from people moving there and the underlying strength of their economies.

What are the largest risks facing the real estate market over the next two years?

Significant risks include a recession in the economy, increasing interest rates, lack of housing affordability, and impending changes in regulation. Other risks include potential reductions in property values within those locations most vulnerable to climate change and rising uncertainty about the world’s economy.