Recently, real estate crowdfunding has turned into one of the most accessible and popular ways to invest in real estate, and it does not take any hefty amount of capital at an initial stage.

It allows several investors to pool funds for one real estate project.

Whether you’re an entrepreneur who’s looking at How to Start a Real Estate Crowdfunding Business or an investor interested in learning more about the business, this comprehensive guide shall walk you through everything that is important to know.

What is Real Estate Crowdfunding?

Real estate crowdfunding is a method of raising capital for real estate endeavors by pooling smaller amounts from a large number of investors.

This model presents opportunities to individuals to invest in real estate without buying entire properties or taking up direct management responsibilities.

Other platforms, including Fundrise and RealtyMogul, can provide investment opportunities in projects that range from residential to commercial real estate, starting as low as $500.

A typical crowdfunding in real estate would involve a real estate developer or business looking for funds for any particular project, say construction of an apartment building.

He puts up his opportunity on a crowdfunding platform, where individual investors decide how much to invest. In turn, they receive a portion of ownership or a fixed interest rate on their investment, depending upon the model used.

Also Read: The Biggest Top PropTech Trends of 2024/2025 That Are Changing Real Estate Forever!

Benefits in Real Estate Crowdfunding

The benefits that real estate crowdfunding offers to developers and investors in general are enormous, including but not limited to the following:

- Diversification: Money in this form of real estate investing is scattered among projects, therefore minimizing risk.

- Accessibility: Most cases involve both accredited and non-accredited investors being allowed to participate.

- Passive income: Without any management headaches associated with property, the investor reaps returns.

- Lower barrier to entry: You are no longer required to be a millionaire to be able to invest in real estate. Most platforms allow you to start with small sums of money.

How Real Estate Crowdfunding Works

Real estate crowdfunding works much the same as other crowdfunding sites used to launch a product or to fund startups. Here is how it works in a step-by-step manner:

- Developer posts project details: A real estate developer in need of raising capital sends in his project to such a crowdfunding platform. The platform vets the project for viability and returns.

- Investors invest capital: At this stage, investors on the platform determine whether they want to invest in the project. It’s at this stage that contributions can range from a few hundred to tens of thousands of dollars.

- Project gets funded: After reaching the funding goal of a particular project, the accumulated capital is transferred to the developer, who then implements the project.

- Investors receive returns: During the development of the project, the investors start to receive dividends or interest payments based on their success of the project and the crowdfunding model chosen.

Why Start a Real Estate Crowdfunding Business?

Starting up a real estate crowdfunding business is the chance to be at the vanguard of responding to increased demand for alternative models of investment.

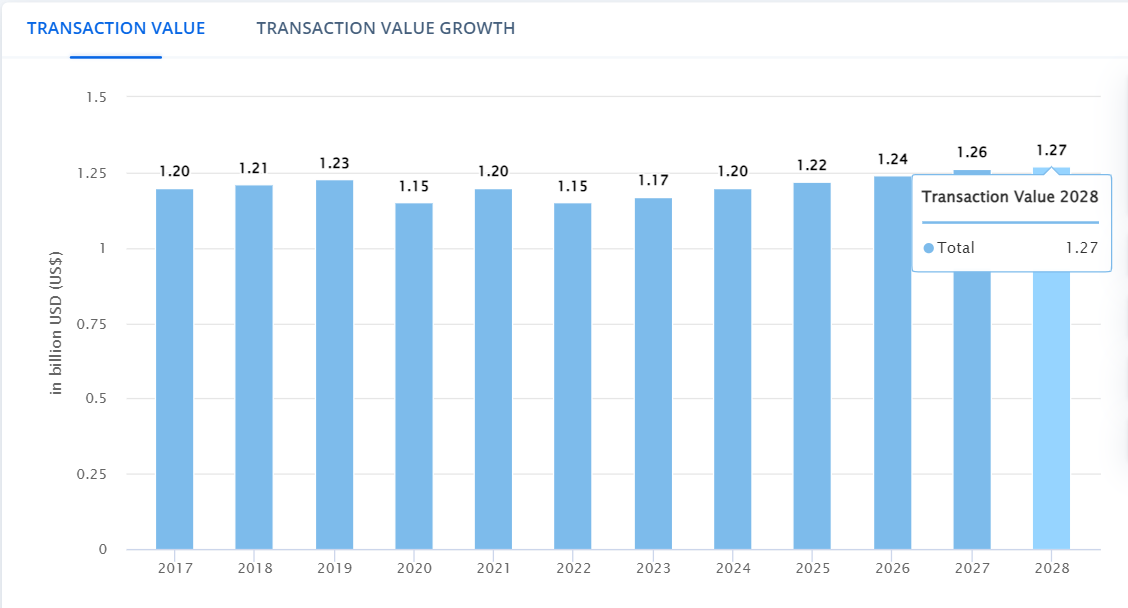

According to a report by Statista, the market size of the real estate crowdfunding sector is expected to reach about $1.27 billion by 2028.

This exponential growth is supported by increases in technological advancement and changes in investor behavior, especially among younger generations in search of new ways to build wealth.

Key Benefits of Starting a Real Estate Crowdfunding Business

- Democratization of Real Estate Investment: Crowdfunding breaks down barriers in investing in real estate to ordinary people who invest in real estate. Since these will be your target investors on your platform, you are adding value to a big pool of prospects that could be your clients.

- Scalability: Once your platform is in place, it is fairly easy to scale. This means that while you are easily focusing on expanding your portfolio of projects and business directly, investment management, payments, investor relations, etc., get automated.

- Recurring Revenue: Typically, real estate crowdfunding platforms generate revenues through management fees, typically around 1 to 2 percent of funds raised, and performance fees, in the form of a percentage of profits.In this manner, this type of model can become highly lucrative, providing a recurring flow of income, which multiplies over time as your platform scales and accepts more users.

- Lower overhead: Unlike traditional real estate businesses, a real estate crowdfunding business operates much online, with little or no physical property to deal with. This reduces many of the costs associated with property management, staffing, and maintenance.

Market Opportunity for Real Estate Crowdfunding

Real estate crowdfunding is no longer a niche market. It recently experienced exponential growth due to the unparalleled development of technology and changes in regulations that allowed more participants.

This shift in status quo opens an exciting market opportunity for entrepreneurs.

Market Trends and Current Statistics

- Demand Growth: The global real estate crowdfunding market stands at around US$13 billion as of 2023 and is expected to grow at a CAGR of about 58% in the next five years.

- Increased Investor Participation: Real estate crowdfunding projects have involved more than 10 million investors worldwide. As access becomes easier, this number continues to rise.

- Technological advances: Blockchain and smart contracts are foreseen as the future for crowdfunding in real estate investment, enabling security and transparency in transactions.

Why Now is the Best Time to Start

A number of factors make this the best time to create a real estate crowdfunding platform:

- Regulatory Relaxation: In 2012, the JOBS Act allowed non-accredited investors to take part in equity crowdfunding, which includes real estate. This change in attitude opened the doors to many more individuals.

- Investor Appetite for Alternatives: The more volatile the stock market becomes, the more stable return alternatives are sought after. Real estate, and most specifically crowdfunding, offers some of the lower risks with higher rewards.

- Globalization of Crowdfunding: Crowdfunding is no longer constrained by the domestic market. It’s now conceivable that platforms will attract investors and projects from around the world, opening up more avenues of growth.

The business model of real estate crowdfunding, combined with current market trends, positions you for success.

Further, we describe the step-by-step process for starting your own real estate crowdfunding business, covering all legal, financial, and technical aspects.

Step-by-Step Guide on How to Start a Real Estate Crowdfunding Business

How to Start a Real Estate Crowdfunding Business:

- Research the market and choose a niche.

- Understand legal and regulatory requirements (e.g., SEC, JOBS Act).

- Develop a user-friendly platform.

- Build a network of investors and real estate developers.

- Secure funding and establish a marketing strategy.

- Launch your platform and scale for growth.

Let’s get deeper into these step-by-step ways on how to start a real estate crowdfunding business:

1. Market and Industry Research

The initial step before embarking on your real estate crowdfunding business is research into the industry. You have to understand the market dynamics, find out if there are any gaps in the market, analyze the competition, and find out what your platform will bring to the table in terms of uniqueness or difference.

Key Research:

- Competitor Analysis: Review the Fundrise, Crowdstreet, and RealtyMogul platforms, each with existing business models. Discuss the fee structures of each platform, target audience, and types of projects hosted.

- Investor Demographics: What demographics will you be targeting? Are you targeting accredited investors or non-accredited investors? Some platforms only allow high-net-worth individuals, while others allow a broader-based audience.

- Type of Properties: Choose between residential, commercial, industrial, or multi-use properties, depending on demand in the market and according to your competency level.

- New Trends: Be on top of technological changes at all times, especially regarding blockchain, smart contracts, and artificial intelligence, since this may actually influence the manner of operation your platform will assume.

2. Choose Your Business Model

Now, it’s time to decide on the business model of your real estate crowdfunding platform. You can follow a few directions depending on whom you plan to address and what types of projects you are going to host.

Common Real Estate Crowdfunding Models:

a.) Equity-based Crowdfunding

The investors buy a portion of the property and then receive a share of either the rental income or sale profit.

Pros: higher potential returns; long-term investment.

Cons: Projects have to be super carefully vetted; the risk is tied to the success of the property.

b.) Debt-based Crowdfunding

Investors lend money to the property developer in exchange for fixed interest.

Pros: Returns predictable; risk much lower compared to equity-based models.

Cons: Returns are lower than those in the equity-based model; upside limited.

c.) Hybrid Models

Investors can choose the investment kind and mix between equity and debt models.

d.) Revenue Share Models

The investors or the owner gets the project revenue generated out of the rental income, sale, or a lot of other means.

Pros: Revenue-sharing offers flexibility; allows for profit-sharing without ownership stakes.

Cons: Returns may vary depending on the project returns.

3. Comply with Legal and Regulatory Requirements

Operating a real estate crowdfunding platform comes with serious regulatory obligations. It’s very important to ensure your platform complies with the various federal, state, and international laws, depending on where one will operate.

Key Regulations to Consider:

- JOBS Act: This 2012 regulation is supported by the legalization of providing crowdfunding opportunities to non-accredited investors and the regulation of solicitation by platforms. Ensure your platform complies with the limitations and requirements imposed by the JOBS Act, especially regarding equity crowdfunding under Titles II and III.

- SEC Registration: Normally, one would find that the greater part of the real estate crowdfunding portals in the U.S. are required to be registered with the Securities and Exchange Commission, keeping in mind that they are soliciting capital from investors. The SEC makes sure that these portals comply with the necessary disclosures and compliance standards.

- State Regulations: With regards to crowdfunding, there may be additional regulations in each state, and you will want to make sure you comply with local laws not only where your platform is based but also where your investors reside.

However, non-accredited investors should be allowed to invest in the campaigns, too. Accredited investors have high net worth or income and can afford more risks.

If non-accredited investors are able to invest in these investment opportunities, there may be many more onerous regulatory requirements to comply with, such as limits on investments and disclosures.

How to Ensure Legal Compliance

Avail the services of lawyers specializing in real estate and securities law to ensure your business complies with all relevant regulations.

Verify the investor’s accreditation by using third-party services like JUMPSTARTSECURITIES.COM or FINRA.org.

4. Build Your Crowdfunding Platform

Your real estate crowdfunding business takes a very important part when it comes to investing in your platform. The experience which the investors and the developers would have with your platform should be easily accessible, secure, and credible.

Must-Haves of Crowdfunding Platform:

- User-Friendly Interface: This refers to an intuitive and neat design, which may attract investors for its easy browsing through projects, reading in-depth information, and investing.

- Project Vetting and Approval System: A process of review and approval is required regarding real estate projects before listing on this platform to ensure only the best and most desirable projects are offered to investors.

- The payment gateway: Very important to be sure of secure payment processing. Integrations like Stripe or PayPal will make it easy to facilitate transactions from an investor’s end.

- Investor Dashboard: Provide access to a web-based dashboard where investors will be able to track their investments, view returns, and refer to key documents associated with projects they have invested in.

- Legal Compliance Tools: Automated tools that can provide ability in managing compliance with the relevant regulations, including the verification of accredited investor status, investment limit management, and making all the necessary disclosures.

Technology Stack to Use:

- Backend: Hosting on AWS or Google Cloud and developing the backend with Python, Node.js, or Ruby on Rails.

- Frontend: React.js or Vue.js can be used for dynamic and responsive user interfaces while working on frontend development.

- Security: SSL Encryption, secure payment gateways, and MFA ensure no leak of customer data security.

5. Develop a Plan for Marketing and Investor Acquisition

A successful marketing strategy is highly needed, which can attract both investors and developers of real estate to your platform.

Real estate crowdfunding is a pretty competitive sector; you’ll have to differentiate this with a value proposition that’s unique and messaging that’s targeted and consistent.

Effective Marketing Channels

- Content Marketing: Create high-value, informative blog articles, videos, and guides to real estate investment, crowdfunding, and financial literacy.

- Target specific keywords such as “how to start a real estate crowdfunding business” and its variants: “real estate crowdfunding for beginners.”

- Newsletters: Make an investor database and send a newsletter every quarter with updates on new projects, investment tips, and any development regarding the platform.

- Social media: LinkedIn, Facebook, and Twitter will be used by publishing there an online presence, success stories, and engaging with potential investors.

- SEO Strategy: SEO your website and platform, using relevant keywords and phrases. Examples include “real estate crowdfunding business model,” “real estate investment platforms,” and “real estate crowdfunding opportunities.”

6. Financial Considerations and Startup Costs

There are several one-time and repeating expenses you will incur in establishing an online real estate crowdfunding business. Understanding the financial cost of establishing and building your website is crucial. The following general estimates provide an idea of the different costs involved in establishing this type of enterprise.

a.) Costs Involved in Establishment: Platform Development Costs: Probably one of the most major costs is developing a robust and user-friendly platform. This, in itself, includes both frontend and backend development.

Estimated cost: From $5,000 to $150,000, depending on the level of complexity and type of features.

b.) Legal and Compliance Fees: Real estate crowdfunding is a highly regulated industry; hence, one would have to allocate a decent budget toward legal advice, regulatory filing, and ongoing compliance.

Cost: Estimated to be from $1,000 to $50,000 for legal setup, inclusive of filing with the Security and Exchange Commission and compliance with the JOBS Act.

c.) Marketing and Investor Acquisition: Marketing will be crucial in acquiring your first investors and real estate developers. This will include digital advertising, content marketing, and possibly even hiring a marketing team.

Cost: Estimated to be between $10,000 and $30,000 in initial marketing campaigns.

d.) Licensing and Permits: Many licenses and permits may be required, based on location of operation and your business model, to legally operate a crowdfunding platform.

Estimated cost: $5,000-$15,000.

e.) Insurance: You will want to consider business liability insurance in order to protect against potential legal claims or disruptions to business operations.

Estimated cost: $2,000-$10,000 annually.

Ongoing Costs:

Moreover, the technology changes so rapidly; one has continuously to update their platform because this brings about security, improvement of user experience, and addition of new features to the platform.

Estimated cost: $5,000-$20,000 annually.

a.) Customer Support: It is very important to provide good customer care if an investor or a developer is to remain satisfied with your services. This might require you to outsource a good customer care team or hire your in-house team.

Estimated cost: $3,000-$60,000 annually, depending on the size of your business.

b.) Compliance and Reporting: You need to be compliant at any given moment in time with the different regulations, from a local to a state and federal level. This takes continuous legal consultations as your platform grows and expands into more markets.

Estimated cost: $10,000-$30,000 per annum.

c.) Marketing and Growth: Where your platform keeps on growing, the volume of your marketing will also continue to grow. Retargeting ads, social media, and content creation all take an ongoing budget.

Estimated cost: $2,000-$100,000 a year, depending on the volume of your marketing activity.

d.) Transaction Fees: Most payment processors and financial services charge some amount of money to your platform for handling transactions. While some platforms pass this cost on to investors, others absorb the fees themselves.

Estimated cost: 1%-3% per transaction.

How to Fund Your Business

There are several ways to fund your real estate crowdfunding business:

a.) Self-Funding: Self-funding will give you all the control in your business. However, this requires immense upfront investment.

b.) Angel Investors or Venture Capital: This route may give you the needed capital to get started in return for equity in your firm.

c.) Loans or lines of credit: Conventional types of financing, such as small business loans or lines of credit, would serve the purpose. Interest rates and modes of repayment cannot be forgotten.

d.) Crowdfunding: You could actually crowdfund to raise funds against your crowdfunding platform. With platforms like Kickstarter or Indiegogo, one can raise funds from individuals in exchange for early access or equity.

7. Building a Network of Investors and Real Estate Developers

A real estate crowdfunding platform requires a great network of investors and developers alike. It is these two entities that the platform will be in constant connection with and needs to build a relationship with for the long term.

Attracting Investors:

The success of your platform will be determined by how well you are able to attract investors who have an interest in real estate opportunities. Here are a few ways to build up your investor pool:

- Educational Content: So, most of your possible investors are not accustomed to crowdfunding for real estate investment and hence may be a little skeptical or unconfident in making an investment through this medium. For this reason, one should provide them with educational resources such as blogs, webinars, and guides.

- Referral Programs: Encourage your existing investors by rewarding them for bringing in more to the platform. For example, offer a bonus when someone they refer has invested.

- Targeted Advertising: Advertise on social media platforms like LinkedIn and Facebook, targeting high net worth or showing interest in real estate investing.

- Partner with Financial Advisors: Network with financial advisors to have them recommend your platform to their clients.

- Investor Events: Host live or virtual events where investors can learn more about your platform and the real estate projects that you have on offer.

Onboarding of Real Estate Developers:

While comparably important to investors, the real estate developers provide projects powering your platform. Here’s how to attract and retain top developers:

a.) Competitive Terms: Your platform offers competitive fees and financing terms compared to traditional funding methods for real estate.

Highlight successful case studies by showing case studies of projects previously funded successfully through your platform. This helps you build some level of credibility, giving reason for developers to consider alternative financing options.

b.) Offer Fast and Easy Process: Make the application process as easy as possible for developers wanting to list projects on your platform. The easier it is to apply, the more developers you will attract.

c.) Developer Partnerships: Build long-term, strong relationships with the same developers who can guarantee quality projects time and again. This may well result in repeat business and a steady flow of new projects.

d.) Highlight your platform’s reach: If you have already developed an extensive network of investors, then let this fact be made known to developers. The bigger your investor pool is, the more attractive your platform will be to these developers who need money to finish their projects.

8. Launching and Growing Your Real Estate Crowdfunding Business

With your platform built and your network set up, it is time to go live with your real estate crowdfunding business. The first months after launching your website are some of the most critical in terms of establishing your brand and attracting users.

Pre-Launch Checklist

Testing of the Platform: Before going live, your platform needs to be tested for bugs, user experience issues, and security gaps.

Soft Launch: Consider a soft launch with a small, tight-knit circle of trusted investors and developers. Note their feedback, then fix all possible bugs that could arise.

Legal Filings: All the required filings for regulations, licenses, and permits should be filed and up to date.

Post-Launch Strategies

- Tap into Your Network: Leverage your network of investors and developers for momentum in the early days. The stories of early success on your platform will attract more and more users.

- Customer Feedback: Be very attentive to customer feedback during the first weeks post-launch. Their insights can give you clues on how to strengthen your platform by addressing initial pain points.

- Continuous Marketing: Keep marketing to continue driving new users onto your platform. Run paid campaigns, attend real estate conferences, or partner with influential people in real estate.

- Refine Your Platform: In concert with the feedback from your users, further iterate on the user experience, security features, and backend functionality of your platform.

- Scale Operations: Once your platform is stable and you have garnered enough initial users, scale into new markets by offering more diverse property types or exploring international real estate opportunities.

Real-World Examples of Successful Real Estate Crowdfunding Platforms

Case studies of some successful crowdfunding businesses in real estate will provide a concrete picture of the strategies that have worked for them. Let’s begin with a few:

a.) Fundrise

Fundrise is one of the most well-known crowdfunding platforms for real estate, offering investment options in the form of equity and debt. Their main product range comprises residential and commercial properties, targeting both accredited and non-accredited investors.

Key Strategy: Fundrise scaled by offering the lowest minimum investment, sometimes as low as $500, and opened up the opportunity for real estate investing to a wider audience.

b.) CrowdStreet

CrowdStreet specializes in commercial real estate, especially large developments, and offers services mainly to accredited investors. To date, they have raised more than $3 billion for projects.

Key Strategy: CrowdStreet uses its online platform to target ultra-high-net-worth individuals who have a high interest in commercial real estate.

c.) RealtyMogul

RealtyMogul originates and administers a variety of real estate investment products, ranging from REITs and equity investments to debt financing. They specialize in a mix of residential and commercial properties.

Key Strategy: RealtyMogul was able to credibly partner with active developers and demonstrate a transparent track record highlighting past investments.

Conclusion

Any real estate crowdfunding business requires huge preparation, a deep knowledge of acting legal regulations, and a well-developed platform.

A well-researched market, an appropriate business model, and a strong network of investors and developers will guarantee an easy-to-use platform that attracts high-quality projects and investors in the niche of real estate.

With this industry continuing to grow, being one step ahead of emerging trends and always maintaining regulatory compliance while continually refining your platform will be extremely important for long-term success.

Now is the time to take action and carve your niche in the world of real estate crowdfunding!

Must Read: Blockchain in Real Estate: How Smart Contracts Are Revolutionizing Property Transactions