Brisbane’s rental market is experiencing significant shifts, with rising demand, tightening vacancy rates, and increasing rental prices.

Recent data from CoreLogic and SQM Research indicate that the city is facing one of the most competitive rental environments in Australia, fueled by strong population growth, migration trends, and a lag in housing supply.

According to SQM Research, Brisbane’s rental vacancy rate has dropped to 1.0% in January 2025, one of the lowest in the country.

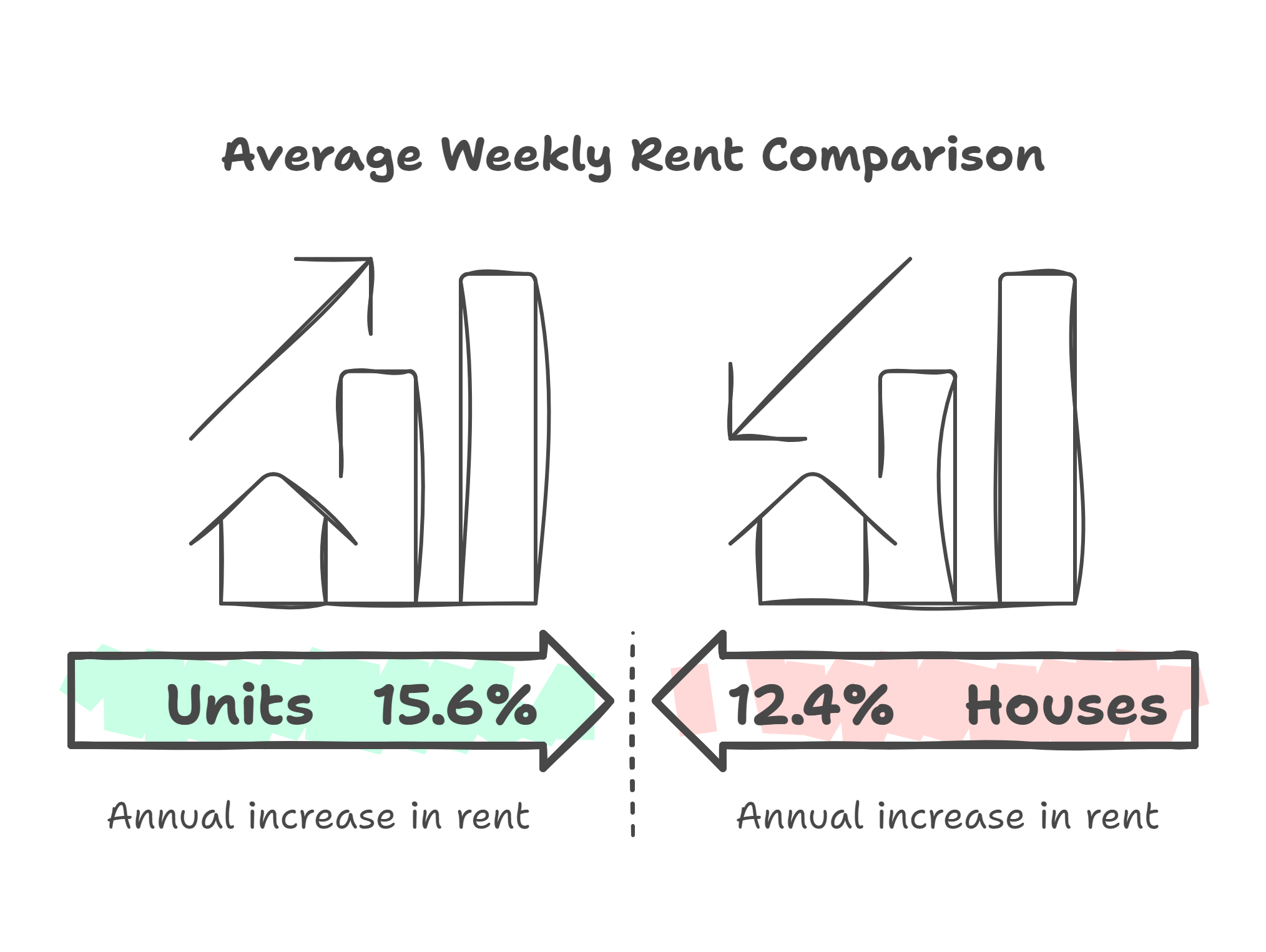

This has put upward pressure on rents, with house rental prices increasing by 12.4% year-over-year while unit rents have surged by 15.6%.

Read: Money 6x REIT Holdings: A Guide to Real Estate Investment Trusts and Building Passive Income

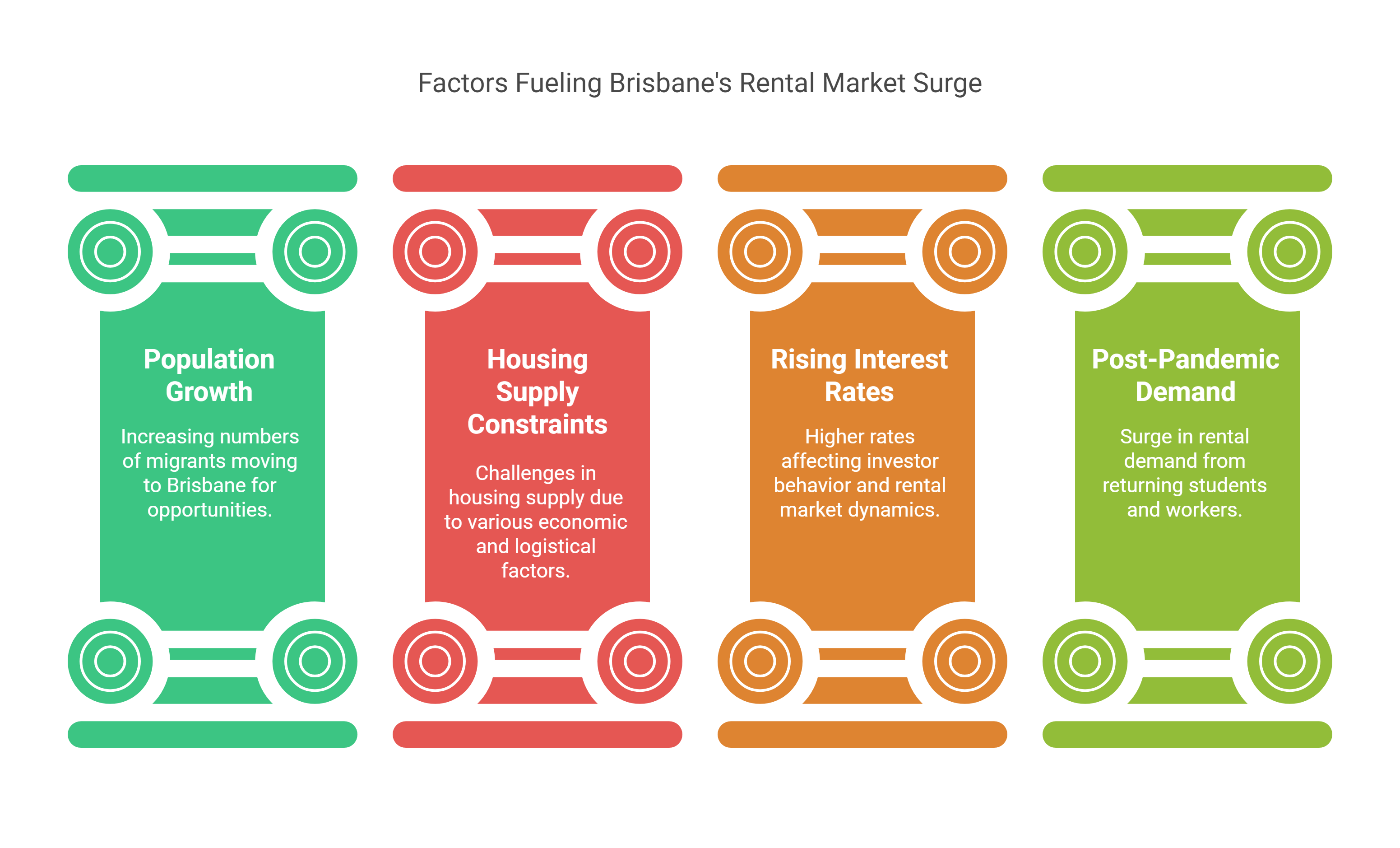

Key Factors Driving Brisbane’s Rental Boom

Several factors contribute to the tightening rental market in Brisbane:

1. Population Growth and Migration Trends

Brisbane has seen a steady influx of interstate and international migrants, particularly from New South Wales and Victoria, due to affordability and lifestyle benefits. Australian Bureau of Statistics (ABS) data shows that Queensland recorded the highest net migration gains in the last two years.

2. Housing Supply Constraints

Despite the growing demand, new housing construction has struggled to keep pace. Delays in development approvals, supply chain disruptions, and rising construction costs have slowed the completion of new rental properties, exacerbating the supply-demand imbalance.

3. Rising Interest Rates and Investor Hesitancy

Higher interest rates have made property investment less attractive for some landlords, reducing the number of rental properties available. Many property investors are opting to sell, further tightening supply.

4. Post-Pandemic Demand for Rental Properties

With international borders open, Brisbane has seen an influx of students, skilled workers, and expatriates looking for rental accommodation. Universities such as the University of Queensland (UQ) and Queensland University of Technology (QUT) are witnessing record international student enrollments, driving demand for inner-city units.

Rental Price Trends in Brisbane

The table below highlights Brisbane’s average rental price growth over the past year:

| Property Type | Avg. Weekly Rent (2023) | Avg. Weekly Rent (2024) | Annual Increase (%) |

|---|---|---|---|

| Houses | $580 | $660 | 12.4% |

| Units | $470 | $544 | 15.6% |

(Source: CoreLogic, SQM Research, March 2024)

With rents rising at double-digit rates, affordability is becoming a growing concern, particularly for lower-income renters who face increasing financial pressure.

Challenges for Renters and Landlords

For Renters:

- Limited Availability: Finding a rental property has become highly competitive, with some listings receiving dozens of applications within hours.

- Rising Costs: Higher rental prices mean tenants are spending a larger portion of their income on housing.

- Increased Bond and Upfront Costs: Some landlords are demanding higher bond payments or longer lease commitments to secure properties.

For Landlords:

- Stricter Regulations: The Queensland government has introduced rental reforms, including restrictions on rent increases and eviction rules, making property management more complex.

- Higher Maintenance Costs: Inflation and supply chain issues have driven up maintenance and repair costs for investment properties.

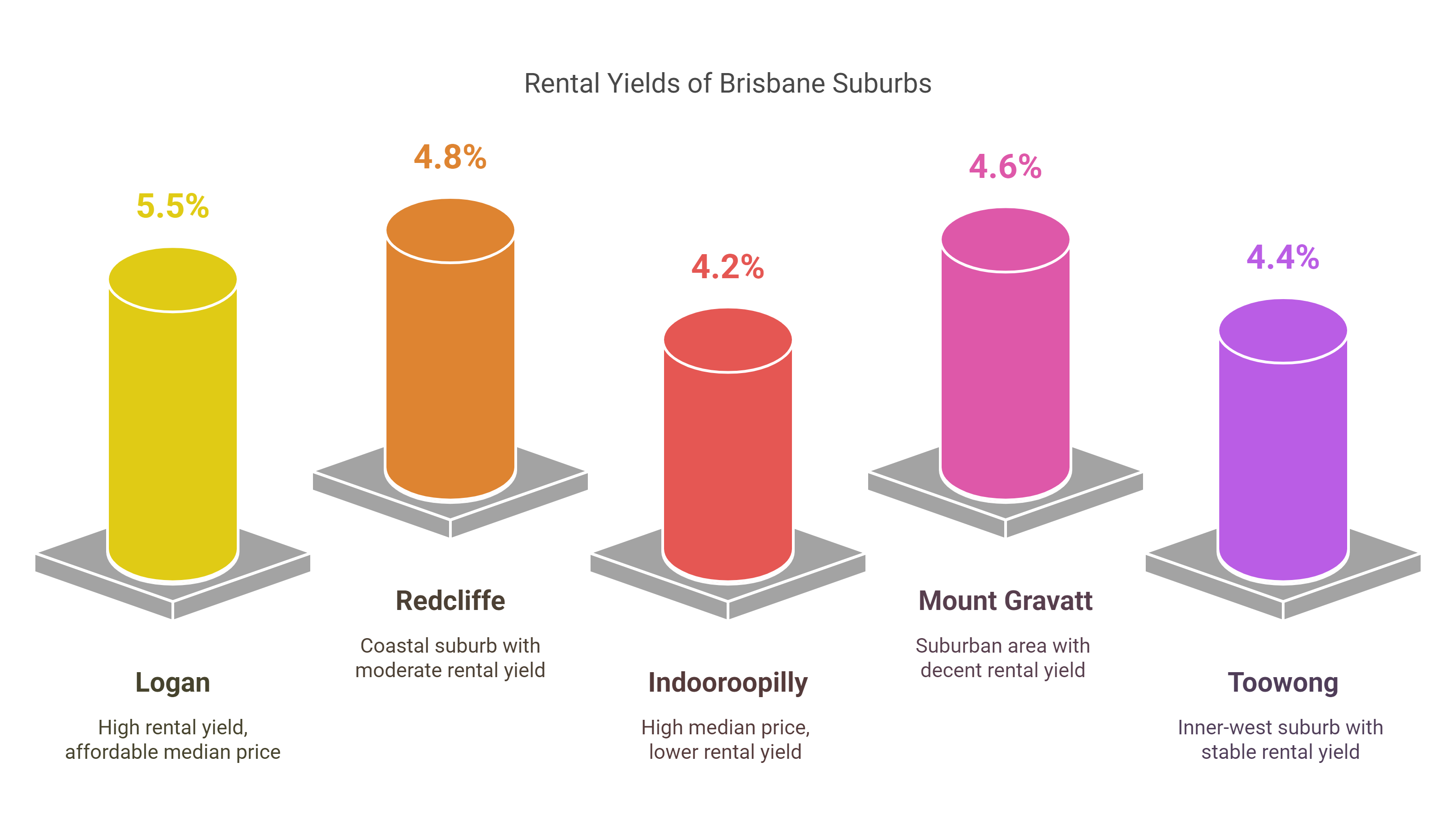

Investment Opportunities in Brisbane’s Rental Market

Despite the challenges, Brisbane remains an attractive market for property investors due to strong demand, rental yield growth, and upcoming infrastructure projects.

Best Suburbs for Investment

According to Domain and PropTrack reports, the following Brisbane suburbs offer high rental yields and strong growth potential:

Key Investment Drivers:

- 2023 FIFA Women’s World Cup and Brisbane 2032 Olympics: Expected to boost infrastructure and property values.

- Major Transport Projects: Cross River Rail and Brisbane Metro improving accessibility.

- High Rental Demand in University Areas: Strong demand from students ensures steady rental income.

Future Outlook: What’s Next for Brisbane’s Rental Market?

Brisbane’s rental market is expected to remain tight in 2025, with further rent increases likely due to ongoing supply shortages. However, potential relief may come from:

- Government Housing Initiatives: The Queensland government has pledged to build more social and affordable housing to ease pressure on the market.

- Increase in Investor Activity: As rental yields rise, more investors may re-enter the market, boosting supply.

- New Unit Developments: Several large-scale apartment projects in the CBD, Fortitude Valley, and West End could provide additional rental stock.

Final Thoughts

Brisbane rental market is in a period of high demand and low supply, pushing rental prices to record levels. While renters face affordability challenges, investors see strong yield opportunities. With major infrastructure projects and international events on the horizon, Brisbane remains a key city to watch in Australia’s property market.

Read: Dubai Prime Real Estate Listings Drop as Supply Tightens: What It Means for Investors