How the 2024 Election Results Will Shape Mortgage Rates and the Real Estate Market

As the dust settles from the 2024 presidential election, both homebuyers and real estate professionals alike will be intently watching what changes, if any, may come from its potential impacts on the nation’s housing market.

Skittishness about mortgage rates and the general economic environment should provide a short-term outlook filled with ups and downs, at best.

A closer examination of implications and possible ripple effects reveals two overriding trends and forecasts that may ultimately typify the market in 2025 and beyond.

Also Read: How Big Data in Real Estate is Changing Forever in 2024/2025 (And How You Can Profit)!

What’s in Store for Mortgage Rates: An Exclusive Look into the 2024 Election

The immediate consequence of such election results is probably going to be erratic fluctuations in mortgage rates.

Experts like Lisa Sturtevant, a Chief Economist at Bright MLS, say mortgage rates may keep inching up as investors react to new fiscal policies, including changes to federal land use and tariffs.

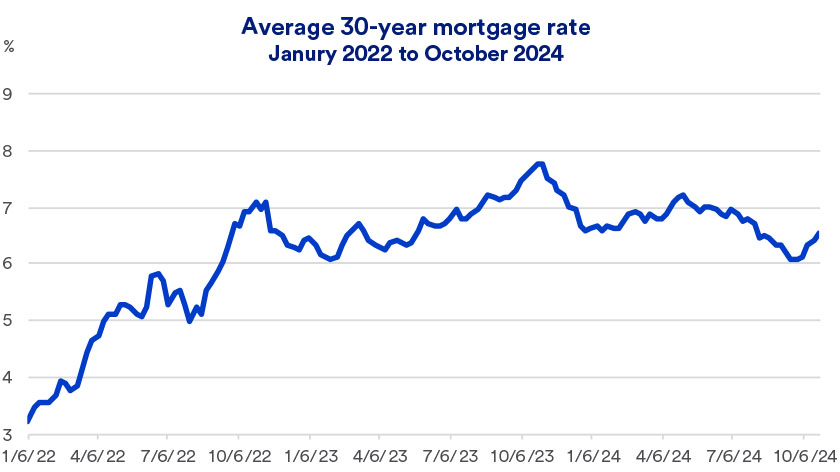

This is further exacerbated by recent increases in the 10-year Treasury bond yields-the usual driver of mortgage rates.

Near-Term Outlook: More Volatile and Higher Mortgage Rates

The national average 30-year fixed-rate mortgage has already increased to 7.13% as of November 6, 2024-the highest level since mid-July. These rates have skyrocketed in part due to election results, with markets rapidly readjusting from expectations of fiscal policy changes.

Of course, another critical factor is the Federal Reserve’s impending interest-rate decision. Many expect a 25 basis-point cut, but economists don’t agree on how many rate cuts the Fed will pursue over the ensuing months.

And if inflation continues to accelerate, as some forecasters believe it will, the Fed may delay further cuts.

Impact on First-Time Homebuyers and Affordability

If election results are any indicator of change, first-time homebuyers may be the most affected by rising rates. At a time when mortgage rates are rising and inflation is starting to creep up, it will be just a little bit harder for moderate-income buyers to get into homeownership.

With policies aimed at benefiting higher-income earners and current homeowners, it could become even tougher for new buyers to get into the market.

Housing Affordability: What Buyers Should Expect

The affordability crisis, already a concern in many markets, may exacerbate further if interest rates were to go even higher.

As Ralph McLaughlin, a Senior Economist at Realtor.com, says, “The market could stay less accessible for many buyers due to high mortgage rates.” It may require buyers to be prepared for higher monthly payments as they work to win their dream homes in competitive markets.

Long-Term Predictions: Mortgage Rates May Fall Slowly

While mortgage rates might remain high in the near future, many experts project a more gradual decrease in the coming years due to tempered pressures of inflation. McLaughlin and other economists project that the real estate market may stabilize by 2025, with mortgage rates possibly turning downward as the economy stabilizes post-pandemic.

A Possible Downward Trend in Mortgage Rates

While this can be an unpredictable housing market, there is still a light at the end of the tunnel for future homebuyers.

The whole thing may balance out over some period when the mortgage rates are at least reasonable and when the Federal Reserve’s priority shifts to getting inflation under control.

Homebuyers who are currently suffering through increased interest rates can look forward to their time passing after some years, finding themselves once again within reach of their dreams of owning a home.

Please Read: The Future of Sustainable Housing in Real Estate: Are You Missing Out on the Latest Breakthroughs 2024?

Real Estate Market Dynamics: What Investors Need to Know

The election also immediately shook real estate stocks, as massive players like Zillow and Compass were seriously beaten down in value.

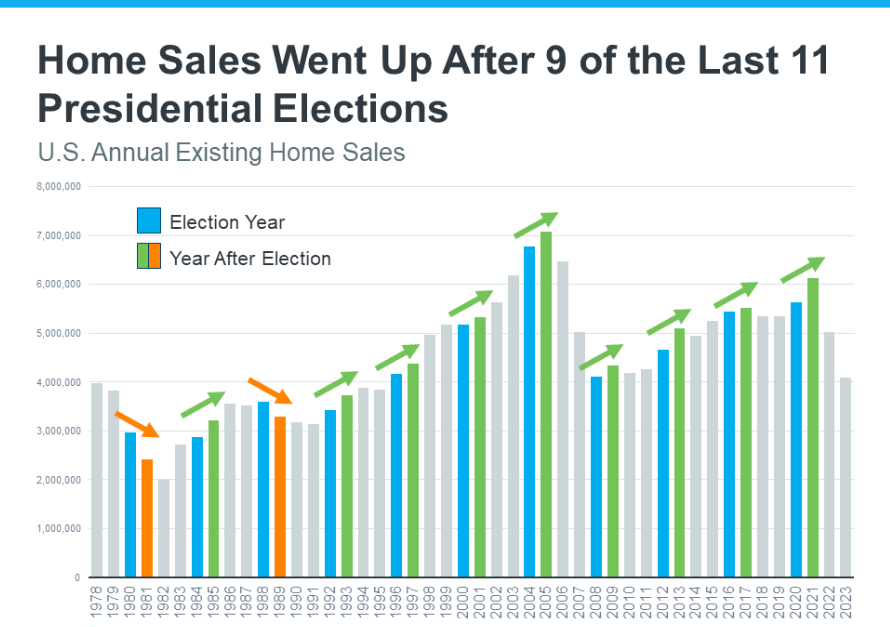

These changes in market conditions suggest that investors are actively looking out for key signs of policy shifts that may affect their portfolios. While some analysts forecast a short-term decrease in home sales, owing to the election, others of the opinion are that the long growth will prevail, especially in supply-constrained markets.

Supply Shortages and Increase in Prices

Perhaps the most significant determinant of house prices is the sustained shortage in supply. As recorded by the National Association of Realtors, even if sales slow down, home prices will remain high because of reduced inventory.

In fact, many areas will likely continue their increases in prices despite the temporary dip in demand, largely in areas where housing construction has not been able to keep up with the population growth.

How to Maneuver the Housing Market in 2025

If you are buying, selling, or investing, having constantly updated information and flexibility are the sole survival tickets to such challenges that the 2024 election results have in store. Real estate pros indicated that prospective buyers should track market trends and be ready for any shift in interest rates and housing prices.

Tips for Buyers and Sellers

- Pre-approval can give you an edge in a competitive market. As mortgage rates fluctuate, the pre-approval for a mortgage will help a buyer be at an advantage in the market. It will also be able to help buyers set a budget and make more informed decisions.

- Know the Local Trends: While national trends are important, real estate markets vary widely by region. Researching local conditions can give buyers and investors a better grounding when making decisions.

- Consider Rentals: Where higher prices have pushed people out of the market for homeownership, rental properties are a way to get into real estate investment without having to make a large down payment.

Conclusion on the Impact of 2024 Election on Mortgage Rates and Real Estate

This will play out constantly, as the country tries to work its way into the new political environment. With mortgage rates likely to be quite volatile for some time, both homebuyers and investors should be very attentive. The long-term outlook now appears to suggest that prices for real estate will continue to appreciate due to supply problems, while rates could eventually fall with easing inflation.

Paying attention to what is going on in the market and adapting will be important for those who need to get in or move around in the real estate market for 2025 and beyond. It empowers buyers, sellers, and investors with the knowledge of how election outcomes impact mortgage rates and home prices to make informed strategic decisions.

Please Read: The Biggest Top PropTech Trends of 2024/2025 That Are Changing Real Estate Forever!